maryland digital advertising tax statute

The lawsuits claim that the ITFA preempts Marylands tax law is unsupported by the text of the ITFA its legislative history or. February 19 2021.

Maryland Digital Advertising Tax Regulations Tax Foundation Comments

At least seven points however bear making.

. Marylands digital advertising law imposes a tax on a percentage of revenues that advertising platforms with over 100 million in annual global revenue earn from digital ads that are served in Maryland. In addition to its economic impact on Maryland businesses and the likelihood of serious legal challenges Marylands proposed digital advertising tax is incredibly vague on vital definitions creating uncertainty about where revenue is sourced and when it is subject to the tax. The highest rate of 10 is imposed on companies with global annual gross revenues of more than 15 billion.

While some states and the District of Columbia have abandoned for now attempts to impose similar taxes several moresuch as Massachusetts New York Texas and West Virginiaare currently advancing legislation nearly. On December 3 2021 the Maryland Comptroller published notice of its adoption of the digital advertising gross revenues tax regulations which was originally proposed. The new tax on revenue earned from digital advertising applies a graduated rate based on the taxpayers global annual revenue.

The Tax has been surrounded by controversy from the very moment it was introduced in the Maryland House of Delegates. He said at the time that it would be unconscionable to raise taxes and fees during a global pandemic and. Chamber of Commerce the Internet Association NetChoice and the.

The legislations ambiguity could lead to double taxation with. Maryland has become the first state in the nation to impose a tax on digital advertising services. The Digital Ad Tax is imposed on a businesss annual gross revenues defined as income or revenue from all sources before any expenses or taxes computed according to generally accepted accounting principles derived from digital advertising services in Maryland.

On February 12 2021 the Maryland General Assembly voted to override Governor Larry Hogans veto of House Bill 732 which carried over from the close of last years legislative session and enacts the nations first gross. Maryland Passes First-of-Its-Kind Digital Advertising Tax. Digital Advertising Gross Revenues Tax ulletin TTY.

The tax rate ranges from 25 to 10 of gross receipts from digital advertising services depending on a companys global annual gross revenues. The potential pitfalls of Marylands proposed digital advertising tax are numerous and the novelty of the proposal means that tax policy experts are still grappling with its implications. 121-cv-410 Bloomberg Law Subscription Four trade associations representing big technology filed a sweeping legal challenge to Marylands first-in-the-nation tax on digital advertising just days after the tax was enacted by the state legislature.

Much of the tax will be borne by in-state companies and individuals. The Maryland Legislature has adopted the first digital advertising tax in the nation. Its a gross receipts tax that applies to companies with global annual gross revenues of.

The statutory references contained in this publication are not effective until March 14 2021. 732 2020 the Maryland Senate on February 12 2021 passed the nations first state tax on the digital advertising revenues pulled in. It is certain not to be the last.

The new tax the Digital Advertising Gross Revenues Tax the Tax became law on February 12 2021. An apportionment fraction is to be used to determine the annual. This new law imposes a tax on annual.

Earlier today the Maryland State Senate completed the General Assemblys override of the Governors veto making the Maryland digital advertising tax the first of its kind in the United States. Saturday December 4 2021. Lawmakers approved House Bill 732 in March 2020 but Governor Larry Hogan vetoed it.

03120102B Proposed Regulation outlining how the states new tax on gross revenues from digital advertising services DAT will operate. The Maryland Senate joined the House of Delegates and voted on February 12 2021 to override the governors veto. Its expected to generate 250 million in its first year.

As such House Bill 732 is now law in Maryland and the new digital advertising services tax is effective for tax years beginning after December 31 2020. In fact a lawsuit to prevent the Comptroller. Maryland recently enacted the nations first tax on digital advertising.

The tax rate is dependent on global annual gross revenues not revenues from Maryland. Effective March 14 2021 the Maryland sales and use tax applies to the sale or use of a digital product or a digital code. House Bill 732 adds a new tax imposed in a new Title 75 to the Tax General Article of the Maryland Code.

On August 31 2021 the Office of the Comptroller of Maryland Maryland Comptroller issued a proposed regulation proposed Md. Overriding the governors veto of HB. The Maryland legislature overrode Governor Larry Hogans veto of a new tax on digital advertising HB.

Its modeled after the digital services taxes weve seen adopted in other countries. At that date the sales and use tax rate on a sale of a digital product or a digital code is 6. The DAT is currently scheduled to take effect on January 1 2022 and.

732 on February 12 2021 making Maryland the first state in the country to adopt a tax on digital advertising. Just days after Maryland became the first state in the country to impose a tax on digital advertising targeting Big Tech lobbying groups representing companies including Amazon Facebook Google. On November 24 2021 the Office of the Comptroller of Maryland MD Comp adopted final regulations outlining how the states new tax on gross revenues from digital advertising services DAT will operate Md.

03120101 - 03120106 Final RegulationsThe DAT is currently scheduled to take effect on January 1 2022 and will apply to persons with annual gross. Maryland Relay 711 Comptroller of Maryland Revenue Administration Division 110 Carroll Street Annapolis Maryland 21411 410-260-7980 Baltimore area or 1-800-638-2937 elsewhere in Maryland E-mail.

Maryland Comptroller Adopts Digital Advertising Gross Revenues Tax Regulations

Just When You Thought You Were Out The Maryland Comptroller Drops Proposed Sourcing Reg For The Digital Ad Tax Eversheds Sutherland Us Llp Jdsupra

Maryland Digital Advertising Tax Regulations Tax Foundation Comments

Massachusetts Joins The Digital Advertising Tax Wave Salt Savvy

Just When You Thought You Were Out The Maryland Comptroller Drops Proposed Sourcing Reg For The Digital Ad Tax Eversheds Sutherland Us Llp Jdsupra

Maryland Digital Advertising Tax Litigation Focus Moves To State Courts

Maryland Digital Advertising Services Tax Kpmg United States

Digital Ad Tax Argued In Maryland Federal Court Case The Seattle Times

Maryland Digital Advertising Services Tax Delay Likely

We Got Nothing Maryland Comptroller Finalizes Digital Advertising Tax Regs Salt Shaker

Just When You Thought You Were Out The Maryland Comptroller Drops Proposed Sourcing Reg For The Digital Ad Tax Eversheds Sutherland Us Llp Jdsupra

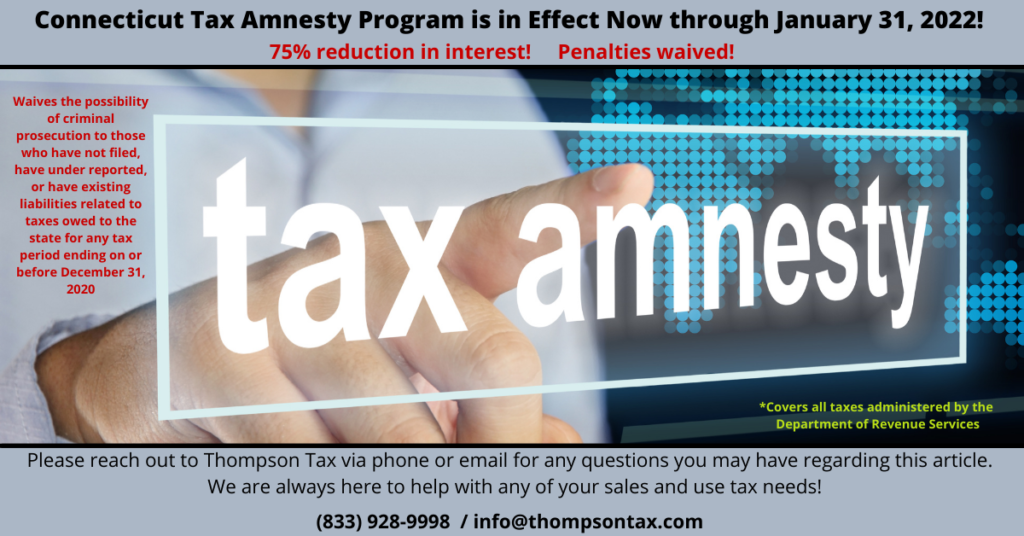

Sales And Use Tax Thompson Tax

Md Digital Advertising Tax Bill

Maryland To Implement Digital Ad Services Tax Grant Thornton

Maryland Digital Advertising Tax Litigation Focus Moves To State Courts

Maryland Digital Advertising Tax Regulations Tax Foundation Comments

Let S Talk About State Taxes And Nexus Advanced American Tax